Bob Solow (85) helyenként vállveregető, helyenként erősen kritikus recenziója Richard Posner: "A Failure of Capitalism: The Crisis of '08 and the Descent into Depression" című, a jelen válság okait és következményeit boncolgató könyvéről. Az alábbi tanulságban mindketten - és vélhetően rajtuk kívül még nagyon sokan - egyetértenek:

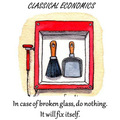

„A modern capitalist economy with a modern financial system can probably adapt to minor shocks—positive or negative—with just a little help from monetary policy and mostly automatic fiscal stabilizers: for example, the lower tax revenues and higher spending on unemployment insurance and social assistance that occur in a weakening economy without any need for deliberate action. It is easy to be lulled into the comfortable belief that the system can take care of itself if only do-gooders will leave it alone. But that same financial system has intrinsic characteristics that can make it self-destructively unstable when it meets a large shock. One such characteristic is asymmetric information: some market participants know things that others don't, and can turn that knowledge into profit. Another is the capacity of financial engineering to produce securities so complicated and opaque—for example, collateralized debt obligations and other exotic derivatives—that almost no one in the market can understand their implications.”